Understanding the Impact of Tariffs on Consumers and Businesses

By David M. Rothschild

In recent news, President Trump threatened to impose tariffs on imports from Canada, Mexico, and China. Specifically, the proposed new tariffs were a 25% tax on imports from Canada and Mexico, and a 10% tariff on goods from China, effective as of Tuesday (he “postponed” them on Monday for Canada and Mexico). While the headlines highlight these political actions, there’s a gap in the conversation when it comes to explaining what these tariffs would actually mean for the average consumer and business owner. Generally the experts agree on the impact of tariffs, how they could impact the typical American, but mainstream media coverage on it has been sensationalized and focused more on the uncertainty over how the tariffs will play out politically in the upcoming weeks. Ironically, if people understood how they could play out economically, it could shift how they play out politically.

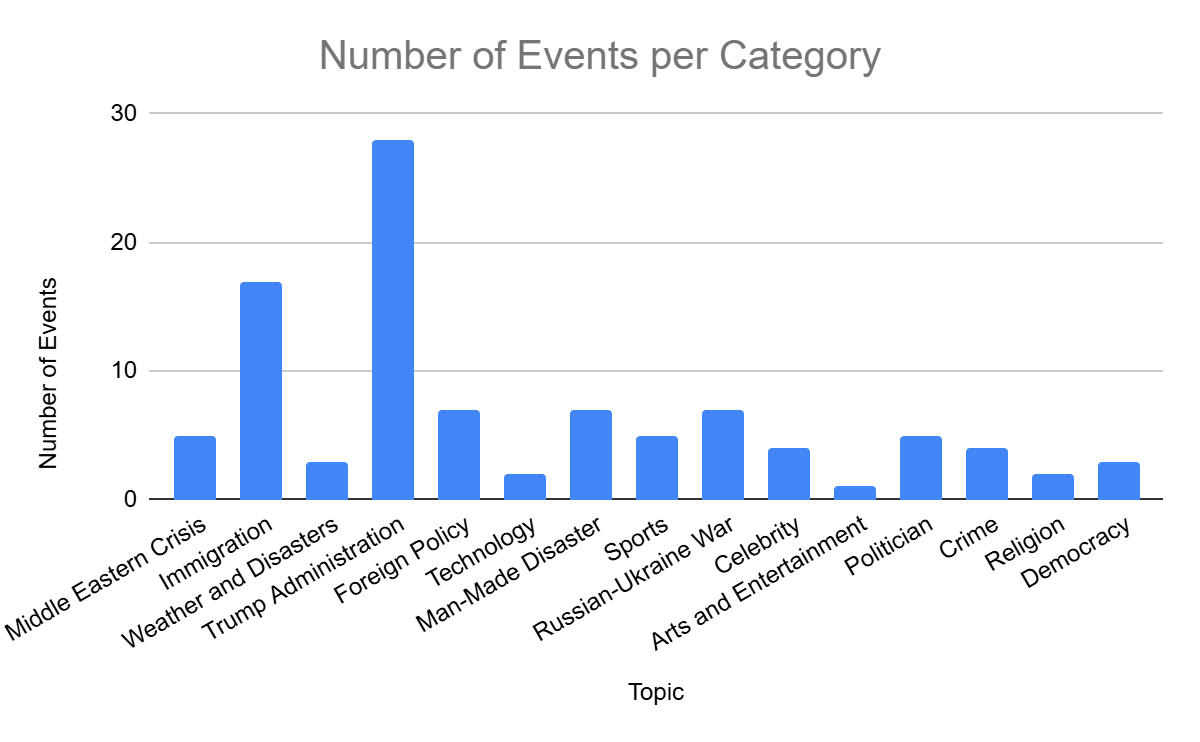

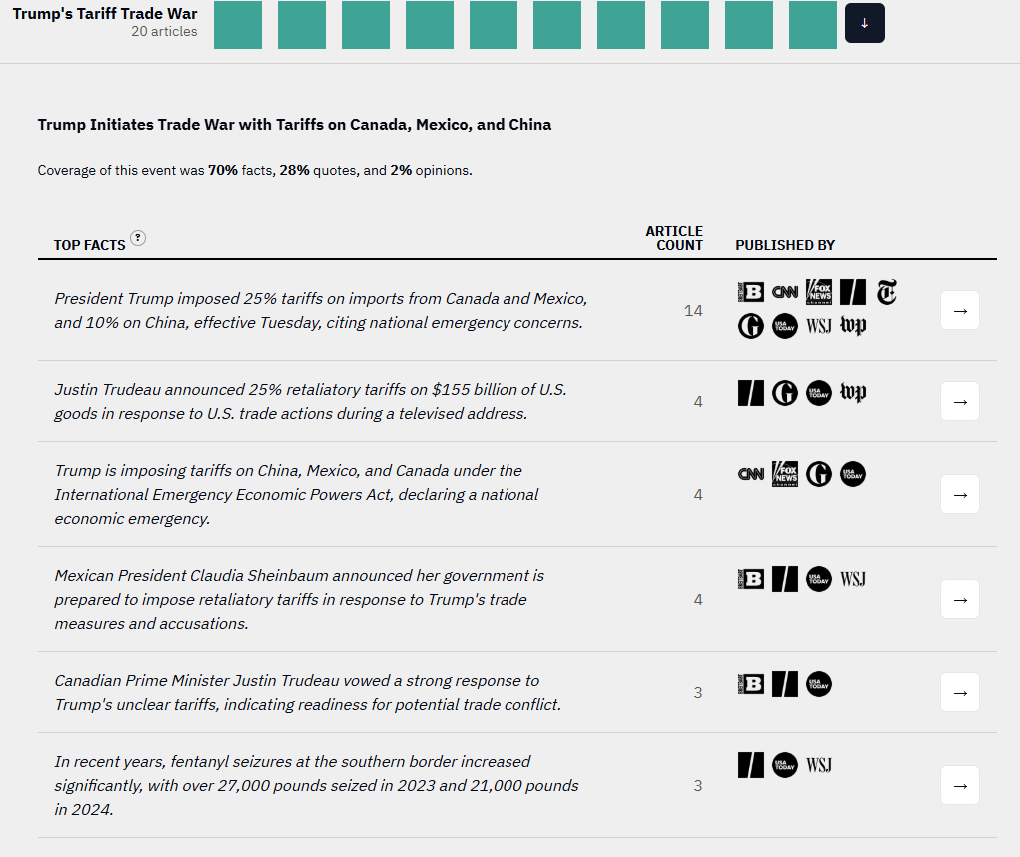

Here are the top facts addressed in the articles published on Saturday February 1, 2025 in the 10 publications we track in the Media Bias Detector. The first fact just lists the details of the US tariffs, the second fact lists the details of the retaliatory tariffs from Canada, the third fact notes the power of how the president is able to raise taxes (a right normally reserved for congress), the fourth fact noted Mexico’s retaliatory tariffs, the fifth highlights the geopolitical conflict, and the final fact discusses drug seizures on the southern border. None of these facts answer the question of how this would affect the typical American. The wording of these facts, which invoke phrases such as “national economic emergency” and “potential trade conflict,” frame the issue as dramatic and uncertain–in a word, exciting–rather than as misinformed and likely harmful.

So, let’s break it down for you:

1. Who Really Pays for the Tariffs?

Although tariffs are technically taxes paid by companies that import goods, the reality is that U.S. consumers will feel most of the financial burden. Here’s why:

2. The Problem of Uncertainty

One of the biggest issues with tariffs is the uncertainty they create.

3. Retaliatory Tariffs from Canada and Mexico

In response to the U.S. tariffs, both Canada and Mexico would implement their own retaliatory tariffs on U.S. goods. While these tariffs will be paid by their citizens, the impact is twofold:

In Conclusion

If Trump does eventually impose these tariffs (i.e., import taxes), the U.S. consumer is likely to feel the brunt of these tariffs in the form of higher prices on everyday goods. The uncertainty surrounding the future of these tariffs only adds to the burden, making it harder for businesses to plan effectively. Additionally, retaliatory tariffs from Canada and Mexico will further strain trade relations, and U.S. manufacturers could lose business.

The goal of securing the U.S. border is important, but it's worth considering whether these tariffs are the best tool for the job. After all, the Canada-U.S. border is already one of the most secure in the world already, so it’s unclear what tariffs could accomplish.